CityPay Payment API

Version: 6.6.40 Last Updated: 2024-04-22

Welcome to the CityPay API, a robust HTTP API payment solution designed for seamless server-to-server transactional processing. Our API facilitates a wide array of payment operations, catering to diverse business needs. Whether you're integrating Internet payments, handling Mail Order/Telephone Order (MOTO) transactions, managing Subscriptions with Recurring and Continuous Authority payments, or navigating the complexities of 3-D Secure authentication, our API is equipped to support your requirements. Additionally, we offer functionalities for Authorisation, Refunding, Pre-Authorisation, Cancellation/Voids, and Completion processing, alongside the capability for tokenised payments.

Compliance and Security Overview

Key Compliance and Security Measures

- TLS Encryption: All data transmissions must utilise TLS version 1.2 or higher, employing strong cryptography. Our infrastructure strictly enforces this requirement to maintain the integrity and confidentiality of data in transit. We conduct regular scans and assessments of our TLS endpoints to identify and mitigate vulnerabilities.

- Data Storage Prohibitions: Storing sensitive cardholder data (CHD), such as the card security code (CSC) or primary account number (PAN), is strictly prohibited. Our API is designed to minimize your exposure to sensitive data, thereby reducing your compliance burden.

- Data Masking: For consumer protection and compliance, full card numbers must not be displayed on receipts or any customer-facing materials. Our API automatically masks PANs, displaying only the last four digits to facilitate safe receipt generation.

- Network Scans: If your application is web-based, regular scans of your hosting environment are mandatory to identify and rectify potential vulnerabilities. This proactive measure is crucial for maintaining a secure and compliant online presence.

- PCI Compliance: Adherence to PCI DSS standards is not optional; it's a requirement for operating securely and legally in the payments ecosystem. For detailed information on compliance requirements and resources, please visit the PCI Security Standards Council website https://www.pcisecuritystandards.org/.

- Request Validation: Our API includes mechanisms to verify the legitimacy of each request, ensuring it pertains to a valid account and originates from a trusted source. We leverage remote IP address verification alongside sophisticated application firewall technologies to thwart a wide array of common security threats.

Getting Started

Before integrating with the CityPay API, ensure your application and development practices align with the outlined compliance and security measures. This preparatory step is crucial for a smooth integration process and the long-term success of your payment processing operations.

For further details on API endpoints, request/response formats, and code examples, proceed to the subsequent sections of our documentation. Our aim is to provide you with all the necessary tools and information to integrate our payment processing capabilities seamlessly into your application.

Thank you for choosing CityPay API. We look forward to supporting your payment processing needs with our secure, compliant, and versatile API solution.

Base URLs

| Production processing endpoint | https://api.citypay.com |

| Testing service returning test results for all transactions | https://sandbox.citypay.com |

Contact Details

Please contact CityPay Support

- At our online CityPay Service Desk

- Or via our website at https://www.citypay.com/contacts/

For any transaction investigations or integration support, please provide your

- merchant id

- a context id or identifier

- a date and time of the request

Authentication

cp-api-key Authentication Header

The cp-api-key can be generated locally by using the SDK preventing any development. It may also be generated by calling

the /authenticate path with a simplified http function.

The cp-api-key authentication header is essential for securing all payment processing activities. Each request made

with this key is rigorously validated for enhanced security. This includes checks against an approved list of IP

addresses and thorough examination by the CityPay application firewall, aimed at providing robust security protection

and effective mitigation of potential attacks.

Key Features and Best Practices

- Temporal and Time-Based: The

cp-api-keyis designed to be temporal, rotating frequently to mitigate replay attacks. This ensures that computation can derive your client details from the request securely. - Confidentiality: The key must remain confidential at all times. Despite our advanced security measures to protect the key, minimizing exposure is crucial. The key is your permission to process transactions; thus, its security is of utmost importance.

- Versatility: This key enables processing across multiple merchant accounts under your CityPay account, offering operational flexibility.

- HTTP Header Utilization: For added security, the key is transmitted via an HTTP header. This method helps prevent potential logging mechanisms from capturing sensitive information, keeping authentication details separate from the transaction data.

- Time-to-Live (TTL): Keys have a TTL of 5 minutes in production environments and 20 minutes in Sandbox environments, ensuring they are used within a secure timeframe.

- Rotation Recommendation: Frequent rotation of the

cp-api-keyis strongly recommended, ideally with each API call, to significantly reduce the risk of unauthorized access.

To generate a valid cp-api-key, you need:

- Your client ID

- Your client key

Key Generation Algorithm

- Nonce Creation: Generate a 256-bit nonce value, e.g.,

ACB875AEF083DE292299BD69FCDEB5C5. - Date-Time Value: Create a

dtvalue with the current date and time in theyyyyMMddHHmmformat, converted to bytes from a hex representation. - Hash Generation: Produce a HmacSHA256 hash using your client license key by concatenating

clientid,nonce, anddt. - Packet Assembly: Form a packet with

clientId,nonce, and hash, delimited by\u003A. - Base64 Encoding: Encode the packet in Base64 format.

This method ensures each cp-api-key is securely generated and uniquely tied to your client credentials, bolstering the security of your transactions.

The following example uses JavaScript and CryptoJS

export function generateApiKey(clientId, licenceKey, nonce, dt = new Date()) {

if (!nonce) {

nonce = CryptoJS.lib.WordArray.random(128 / 8);

} else if (typeof nonce === 'string') {

nonce = Hex.parse(nonce);

} else {

throw new Error("Unsupported nonce type");

}

const msg = Utf8.parse(clientId)

.concat(nonce)

.concat(CryptoJS.lib.WordArray.create(dtToBuffer(dt)));

const hash = HmacSHA256(msg, Utf8.parse(licenceKey));

const packet = Utf8.parse(clientId + '\u003A' + nonce.toString(Hex).toUpperCase() + '\u003A').concat(hash);

return Base64.stringify(packet);

}

Example values for unit testing:

let exampleNonce = "ACB875AEF083DE292299BD69FCDEB5C5";

let exampleDate = new Date(2020, 0, 1, 9, 23, 0, 0);

let apiKey = generateApiKey("Dummy", "7G79TG62BAJTK669", exampleNonce, exampleDate);

expect(apiKey).toBe('RHVtbXk6QUNCODc1QUVGMDgzREUyOTIyOTlCRDY5RkNERUI1QzU6tleiG2iztdBCGz64E3/HUhfKIdGWr3VnEtu2IkcmFjA=');

API Key Authentication: cp-domain-key

The cp-domain-key serves as a crucial component for host-based authentication in scenarios where integrations occur

via direct HTTPS calls. This authentication method is specifically designed to ensure secure communication between

pre-registered domains and our API.

Key Features and Usage

- Host-Based Authentication: The

cp-domain-keyis essential for authenticating HTTP requests originating from registered host domains. This method provides an additional layer of security by verifying that the request comes from a trusted source. - Domain Validation: Each request made using the

cp-domain-keyundergoes validation against a prefixed list of host addresses. Furthermore, theOriginorRefererheader within the HTTP request is meticulously checked to confirm the request's legitimacy. - Application Firewall: To safeguard against potential security threats and ensure robust attack mitigation, all calls authenticated with the

cp-domain-keyare scrutinized by the CityPay application firewall. This comprehensive security measure is in place to protect your transactions and data from unauthorized access and various forms of cyber attacks. - Integration with HTML Forms: The

cp-domain-keycan be seamlessly integrated into HTML forms as an authentication token. This feature is particularly useful for applications requiring secure form submissions from pre-registered domains. - Multiple Domain Registration: Our system supports the registration of multiple domains under a single

cp-domain-key. This flexibility allows for the secure management of various domains, facilitating host-based calls across your digital ecosystem. - Exclusive to Host-Based Calls: It's important to note that the

cp-domain-keyis exclusively designed for host-based authentication. Only calls originating from registered domains are permitted to use this authentication method, ensuring a high level of security and integrity for your API interactions.

Requirements for Use

To utilise the cp-domain-key authentication, you must have:

- Merchant ID: Your unique identifier as a merchant within our system.

- Access/Licence Key: A secure key provided to you for API access and operations.

By adhering to these guidelines and requirements, you can ensure secure and efficient host-based authentication for your HTTPS calls, leveraging the cp-domain-key to protect your data and transactions.

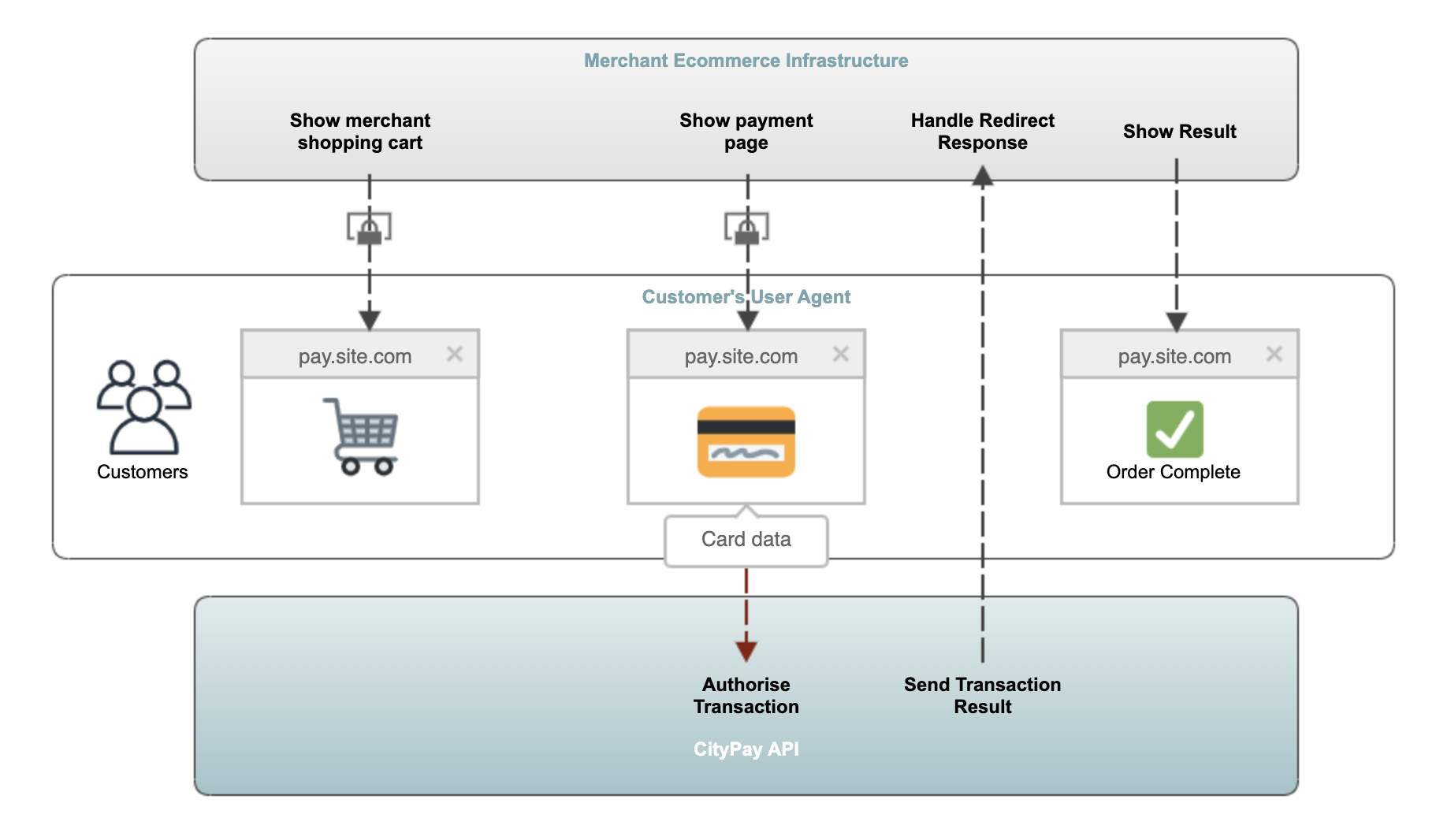

Authorisation and Payment Api

The Payment Processing API is designed for MOTO (Mail Order/Telephone Order), e-commerce, and continuous authority transactions. It incorporates advanced fraud and risk assessments, 3D Secure authentication flows, and transaction querying capabilities to streamline your payment operations securely.

Understanding the Authorisation Process

The authorisation process is a critical component in payment processing, enabling standard transaction authorisation based on the parameters provided in its request. The CityPay gateway facilitates this by routing your transaction through to an Acquiring bank and to the appropriate card scheme, such as Visa, MasterCard or American Express.

Our API is optimized for server environments that process transactions in real-time. It supports various transaction types, including:

- E-commerce

- Mail order and telephone order

- Customer present transactions (keyed entry)

- Continuous authority and pre-authorisation

We tailor your account with specific acquirer configurations to ensure smooth transactions through our gateway.

Different transaction environments may require specific data elements. Our API is designed to be flexible, accommodating these various requirements with the support of our dedicated integration team.

E-commerce workflows

Our API simplifies 3D Secure integrations for e-commerce transactions, reducing the need for direct accreditation with Visa and MasterCard. This built-in mechanism manages authentication processes and enhances security by shifting potential liability from the merchant to the cardholder. The authentication produces a Cardholder Authentication Verification Value (CAVV) and an E-commerce Indicator (ECI) that are crucial for the transaction validation.

CityPay supports 3DS version 2.2, aligned with EU regulations for Secure Customer Authentication (SCA), and is compatible with Verified by Visa, MasterCard Identity Check, and American Express SafeKey 2.2.

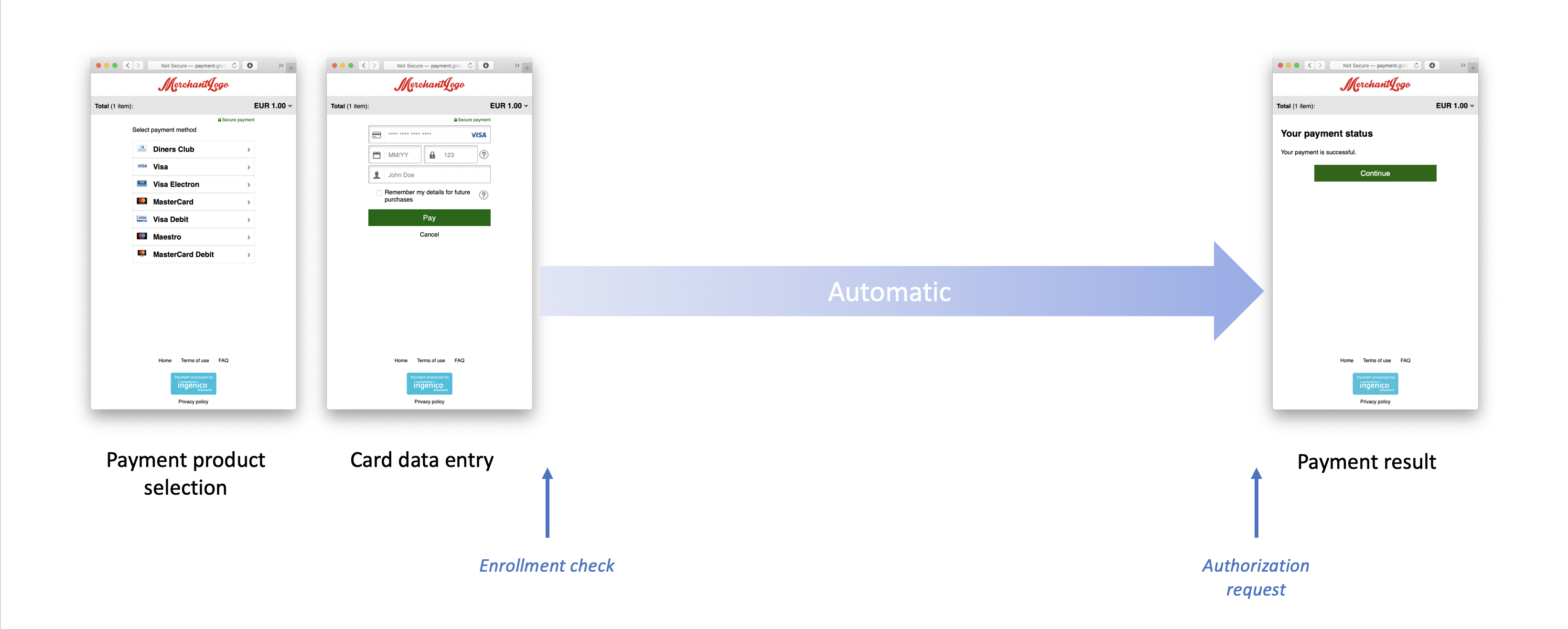

Non-3D Secure Transactions

Some transactions may bypass 3D Secure processing due to authentication issues or deliberate "attempted" checks. These transactions will not qualify for a liability shift and could be declined.

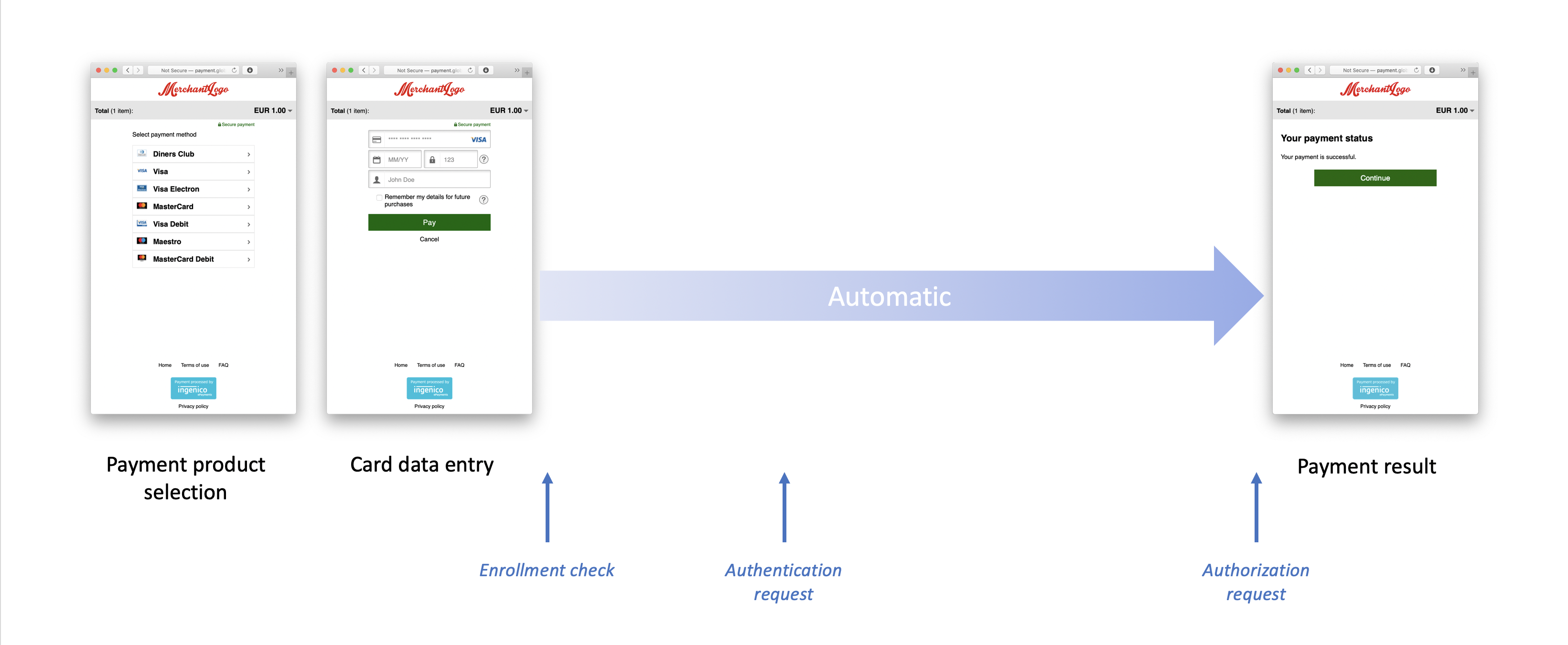

Frictionless 3D Secure

For low-risk transactions, our API supports a frictionless 3D Secure process. It allows for authentication without disrupting the user experience, requiring no redirection or additional interaction from the cardholder.

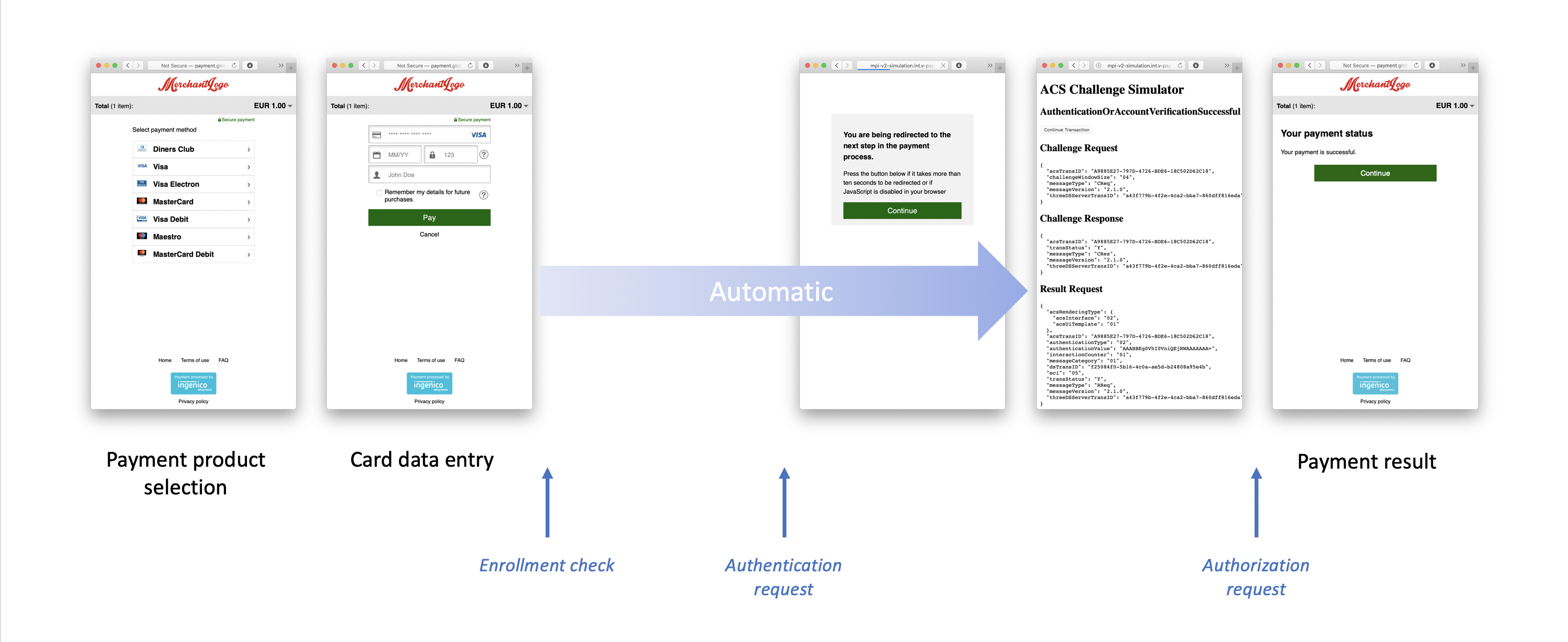

Challenged 3D Secure

Higher-risk transactions may be "challenged," requiring the cardholder to authenticate the transaction. In such cases,

the API will return a request challenge which will require your integration to forward the

cardholder's browser to the given ACS url. This should be performed by posting the creq value

(the challenge request value).

Once complete, the ACS will have already been in touch with our servers by sending us a result of the authentication

known as RReq.

To maintain session state, a parameter threeDSSessionData can be posted to the ACS url and will be returned alongside

the CRes value. This will ensure that any controller code will be able to isolate state between calls. This field

is to be used by your own systems rather than ours and may be any value which can uniquely identify your cardholder's

session. As an option, we do provide a threedserver_trans_id value in the RequestChallenged packet which can be used

for the threeDSSessionData value as it is used to uniquely identify the 3D-Secure session.

A common method of maintaining state is to provide a session related query string value in the merchant_termurl value

(also known as the notificationUrl). For example providing a url of https://mystore.com/checkout?token=asny2348w4561..

could return the user directly back to their session with your environment.

Once you have received a cres post from the ACS authentication service, this should be POSTed to the cres

endpoint to perform full authorisation processing.

Please note that the CRes returned to us is purely a mechanism of acknowledging that transactions should be committed for authorisation. The ACS by this point will have sent us the verification value (CAVV) to perform a liability shift. The CRes value will be validated for receipt of the CAVV and subsequently may return response codes illustrating this.

To forward the user to the ACS, we recommend a simple auto submit HTML form.

Simple auto submit HTML form

<html lang="en">

<head>

<title>Forward to ACS</title>

<script type="text/javascript">

function onLoadEvent() {

document.acs.submit();

}

</script>

<noscript>You will require JavaScript to be enabled to complete this transaction</noscript>

</head>

<body onload="onLoadEvent();">

<form name="acs" action="{{ACSURL from Response}}" method="POST">

<input type="hidden" name="creq" value="{{CReq Packet from Response}}" />

<input type="hidden" name="threeDSSessionData" value="{{session-identifier}}" />

</form>

</body>

</html>

A full ACS test suite is available for 3DSv2 testing.

Testing 3DSv2 Integrations

The API includes a simulated 3DSv2 handler that executes various scenarios determined by the Card Security Code (CSC) value provided in the transaction request. This feature allows developers to test different outcomes and behaviors in a controlled environment.

| CSC Value | Behaviour |

|---|---|

| 731 | Frictionless processing - Not authenticated |

| 732 | Frictionless processing - Account verification count not be performed |

| 733 | Frictionless processing - Verification Rejected |

| 741 | Frictionless processing - Attempts Processing |

| 750 | Frictionless processing - Authenticated |

| 761 | Triggers an error message |

| Any | Challenge Request |

Authorisation

Performs a request for authorisation for a card payment request.

Basic capture call for a merchant with a given identifier

{

"AuthRequest":{

"amount":"<integer>",

"cardnumber":"<string>",

"expmonth":"<integer>",

"identifier":"<string>",

"merchantid":"<integer>",

"bill_to":{

"address1":"<string>",

"address2":"<string>",

"address3":"<string>",

"area":"<string>",

"company":"<string>",

"country":"<string>",

"email":"<string>",

"firstname":"<string>",

"lastname":"<string>",

"mobile_no":"<string>",

"postcode":"<string>",

"telephone_no":"<string>",

"title":"<string>"

},

"expyear":"<integer>",

"merchant_termurl":"<string>"

}

}

<AuthRequest>

<amount><integer></amount>

<cardnumber><string></cardnumber>

<expmonth><integer></expmonth>

<identifier><string></identifier>

<merchantid><integer></merchantid>

<bill_to>

<address1><string></address1>

<address2><string></address2>

<address3><string></address3>

<area><string></area>

<company><string></company>

<country><string></country>

<email><string></email>

<firstname><string></firstname>

<lastname><string></lastname>

<mobile_no><string></mobile_no>

<postcode><string></postcode>

<telephone_no><string></telephone_no>

<title><string></title>

</bill_to>

<expyear><integer></expyear>

<merchant_termurl><string></merchant_termurl>

</AuthRequest>

Model AuthRequest

Request body for the AuthorisationRequest operation contains the following properties

| Field | Type | Usage | Description |

|---|---|---|---|

amount |

integer int32 | Required | The amount to authorise in the lowest unit of currency with a variable length to a maximum of 12 digits. No decimal points are to be included and no divisional characters such as 1,024. The amount should be the total amount required for the transaction. For example with GBP £1,021.95 the amount value is 102195. minLength: 1 maxLength: 9 |

cardnumber |

string | Required | The card number (PAN) with a variable length to a maximum of 21 digits in numerical form. Any non numeric characters will be stripped out of the card number, this includes whitespace or separators internal of the provided value. The card number must be treated as sensitive data. We only provide an obfuscated value in logging and reporting. The plaintext value is encrypted in our database using AES 256 GMC bit encryption for settlement or refund purposes. When providing the card number to our gateway through the authorisation API you will be handling the card data on your application. This will require further PCI controls to be in place and this value must never be stored. minLength: 12 maxLength: 22 |

expmonth |

integer int32 | Required | The month of expiry of the card. The month value should be a numerical value between 1 and 12. minimum: 1 maximum: 12 |

expyear |

integer int32 | Required | The year of expiry of the card. minimum: 2000 maximum: 2100 |

identifier |

string | Required | The identifier of the transaction to process. The value should be a valid reference and may be used to perform post processing actions and to aid in reconciliation of transactions. The value should be a valid printable string with ASCII character ranges from 0x32 to 0x127. The identifier is recommended to be distinct for each transaction such as a random unique identifier this will aid in ensuring each transaction is identifiable. When transactions are processed they are also checked for duplicate requests. Changing the identifier on a subsequent request will ensure that a transaction is considered as different. minLength: 4 maxLength: 50 |

merchantid |

integer int32 | Required | Identifies the merchant account to perform processing for. |

avs_postcode_policy |

string | Optional | A policy value which determines whether an AVS postcode policy is enforced or bypassed. Values are: 0 for the default policy (default value if not supplied). Your default values are determined by your account manager on setup of the account.1 for an enforced policy. Transactions that are enforced will be rejected if the AVS postcode numeric value does not match.2 to bypass. Transactions that are bypassed will be allowed through even if the postcode did not match.3 to ignore. Transactions that are ignored will bypass the result and not send postcode details for authorisation. |

bill_to |

object | Optional | ContactDetails Billing details of the card holder making the payment. These details may be used for AVS fraud analysis, 3DS and for future referencing of the transaction. For AVS to work correctly, the billing details should be the registered address of the card holder as it appears on the statement with their card issuer. The numeric details will be passed through for analysis and may result in a decline if incorrectly provided. |

csc |

string | Optional | The Card Security Code (CSC) (also known as CV2/CVV2) is normally found on the back of the card (American Express has it on the front). The value helps to identify possession of the card as it is not available within the chip or magnetic swipe. When forwarding the CSC, please ensure the value is a string as some values start with 0 and this will be stripped out by any integer parsing. The CSC number aids fraud prevention in Mail Order and Internet payments. Business rules are available on your account to identify whether to accept or decline transactions based on mismatched results of the CSC. The Payment Card Industry (PCI) requires that at no stage of a transaction should the CSC be stored. This applies to all entities handling card data. It should also not be used in any hashing process. CityPay do not store the value and have no method of retrieving the value once the transaction has been processed. For this reason, duplicate checking is unable to determine the CSC in its duplication check algorithm. minLength: 3 maxLength: 4 |

csc_policy |

string | Optional | A policy value which determines whether a CSC policy is enforced or bypassed. Values are: 0 for the default policy (default value if not supplied). Your default values are determined by your account manager on setup of the account.1 for an enforced policy. Transactions that are enforced will be rejected if the CSC value does not match.2 to bypass. Transactions that are bypassed will be allowed through even if the CSC did not match.3 to ignore. Transactions that are ignored will bypass the result and not send the CSC details for authorisation. |

currency |

string | Optional | The processing currency for the transaction. Will default to the merchant account currency. minLength: 3 maxLength: 3 |

duplicate_policy |

string | Optional | A policy value which determines whether a duplication policy is enforced or bypassed. A duplication check has a window of time set against your account within which it can action. If a previous transaction with matching values occurred within the window, any subsequent transaction will result in a T001 result. Values are 0 for the default policy (default value if not supplied). Your default values are determined by your account manager on setup of the account.1 for an enforced policy. Transactions that are enforced will be checked for duplication within the duplication window.2 to bypass. Transactions that are bypassed will not be checked for duplication within the duplication window.3 to ignore. Transactions that are ignored will have the same affect as bypass. |

match_avsa |

string | Optional | A policy value which determines whether an AVS address policy is enforced, bypassed or ignored. Values are: 0 for the default policy (default value if not supplied). Your default values are determined by your account manager on setup of the account.1 for an enforced policy. Transactions that are enforced will be rejected if the AVS address numeric value does not match.2 to bypass. Transactions that are bypassed will be allowed through even if the address did not match.3 to ignore. Transactions that are ignored will bypass the result and not send address numeric details for authorisation. |

name_on_card |

string | Optional | The card holder name as appears on the card such as MR N E BODY. Required for some acquirers. minLength: 2 maxLength: 45 |

ship_to |

object | Optional | ContactDetails Shipping details of the card holder making the payment. These details may be used for 3DS and for future referencing of the transaction. |

tag |

array | Optional | type: string |

threedsecure |

object | Optional | ThreeDSecure ThreeDSecure element, providing values to enable full 3DS processing flows. |

trans_info |

string | Optional | Further information that can be added to the transaction will display in reporting. Can be used for flexible values such as operator id. maxLength: 50 |

trans_type |

string | Optional | The type of transaction being submitted. Normally this value is not required and your account manager may request that you set this field. maxLength: 1 |

Business Extension: Event Management

Supports the event management business extension by adding the following parameters to the request.

| Field | Type | Description |

|---|---|---|

event_management |

object | EventDataModel Additional advice data for event management integration that can be applied to an authorisation request. |

Business Extension: Airline

Supports the airline business extension by adding the following parameters to the request.

| Field | Type | Description |

|---|---|---|

airline_data |

object | AirlineAdvice Additional advice for airline integration that can be applied on an authorisation request. As tickets are normally not allocated until successful payment it is normal for a transaction to be pre-authorised and the airline advice supplied on a capture request instead. Should the data already exist and an auth and capture is preferred. This data may be supplied. |

Business Extension: MCC6012

Supports the mcc6012 business extension by adding the following parameters to the request.

| Field | Type | Description |

|---|---|---|

mcc6012 |

object | MCC6012 If the merchant is MCC coded as 6012, additional values are required for authorisation. |

Business Extension: 3DSv1 MPI

Supports the 3dsv1 mpi business extension by adding the following parameters to the request.

| Field | Type | Description |

|---|---|---|

external_mpi |

object | ExternalMPI If an external 3DSv1 MPI is used for authentication, values provided can be supplied in this element. |

Response

Responses for the AuthorisationRequest operation are

| StatusCode | Description | Content-Type | Model |

|---|---|---|---|

200 |

A decision made by the result of processing. | application/json text/xml |

Decision |

400 |

Bad Request. Should the incoming data not be validly determined. | ||

401 |

Unauthorized. No api key has been provided and is required for this operation. | ||

403 |

Forbidden. The api key was provided and understood but is either incorrect or does not have permission to access the account provided on the request. | ||

422 |

Unprocessable Entity. Should a failure occur that prevents processing of the API call. | application/json text/xml |

Error |

500 |

Server Error. The server was unable to complete the request. |

Bin Lookup

A bin range lookup service can be used to check what a card is, as seen by the gateway. Each card number's leading digits help to identify who

- the card scheme is such as Visa, MasterCard or American Express

- the issuer of the card, such as the bank

- it's country of origin

- it's currency of origin

Our gateway has 450 thousand possible bin ranges and uses a number of algorithms to determine the likelihood of the bin data. The request requires a bin value of between 6 and 12 digits. The more digits provided may ensure a more accurate result.

Model BinLookup

Request body for the BinRangeLookupRequest operation contains the following properties

| Field | Type | Usage | Description |

|---|---|---|---|

bin |

integer int32 | Required | A bin value to use for lookup. minLength: 6 maxLength: 12 |

Response

Responses for the BinRangeLookupRequest operation are

| StatusCode | Description | Content-Type | Model |

|---|---|---|---|

200 |

A result of the bin lookup request returning a bin object determined by the gateway service. | application/json text/xml |

Bin |

400 |

Bad Request. Should the incoming data not be validly determined. | ||

401 |

Unauthorized. No api key has been provided and is required for this operation. | ||

403 |

Forbidden. The api key was provided and understood but is either incorrect or does not have permission to access the account provided on the request. | ||

422 |

Unprocessable Entity. Should a failure occur that prevents processing of the API call. | application/json text/xml |

Error |

500 |

Server Error. The server was unable to complete the request. |

Capture

The capture process only applies to transactions which have been pre-authorised only.

The capture process will ensure that a transaction will now settle. It is expected that a capture call will be provided within 3 days or a maximum of 7 days.

A capture request is provided to confirm that you wish the transaction to be settled. This request can contain a final amount for the transaction which is different to the original authorisation amount. This may be useful in a delayed system process such as waiting for stock to be ordered, confirmed, or services provided before the final cost is known.

When a transaction is completed, a new authorisation code may be created and a new confirmation can be sent online to the acquiring bank.

Once the transaction has been processed. A standard Acknowledgement will be returned,

outlining the result of the transaction. On a successful completion process, the transaction will

be available for the settlement and completed at the end of the day.

Basic capture call for a merchant with a given identifier

{

"CaptureRequest":{

"merchantid":123456,

"identifier":"318f2bc5-d9e0-4ddf-9df1-1ea9e4890ca9"

}

}

<CaptureRequest>

<merchantid>123456</merchantid>

<identifier>318f2bc5-d9e0-4ddf-9df1-1ea9e4890ca9</identifier>

</CaptureRequest>

Basic capture call for a merchant with a transno and final amount

{

"CaptureRequest":{

"merchantid":123456,

"transno":11275,

"amount":6795

}

}

<CaptureRequest>

<merchantid>123456</merchantid>

<transno>11275</transno>

<amount>6795</amount>

</CaptureRequest>

Capture call for a merchant with identifier and airline data once a ticket has been issued

{

"CaptureRequest":{

"merchantid":123456,

"identifier":"318f2bc5-d9e0-4ddf-9df1-1ea9e4890ca9",

"airline-data":{

"carrier-name":"Acme Air",

"transaction-type":"TKT",

"ticketno":"114477822",

"segment1":{

"flight-number":"724",

"carrier-code":"ZZ",

"arrival-location-code":"LGW",

"departure-date":"2020-01-23"

}

}

}

}

<CaptureRequest>

<merchantid>123456</merchantid>

<identifier>318f2bc5-d9e0-4ddf-9df1-1ea9e4890ca9</identifier>

<airline-data>

<carrier-name>Acme Air</carrier-name>

<transaction-type>TKT</transaction-type>

<ticketno>114477822</ticketno>

<segment1>

<flight-number>724</flight-number>

<carrier-code>ZZ</carrier-code>

<arrival-location-code>LGW</arrival-location-code>

<departure-date>2020-01-23</departure-date>

</segment1>

</airline-data>

</CaptureRequest>

Model CaptureRequest

Request body for the CaptureRequest operation contains the following properties

| Field | Type | Usage | Description |

|---|---|---|---|

merchantid |

integer int32 | Required | Identifies the merchant account to perform the capture for. |

amount |

integer int32 | Optional | The completion amount provided in the lowest unit of currency for the specific currency of the merchant, with a variable length to a maximum of 12 digits. No decimal points to be included. For example with GBP 75.45 use the value 7545. Please check that you do not supply divisional characters such as 1,024 in the request which may be caused by some number formatters. If no amount is supplied, the original processing amount is used. minLength: 1 maxLength: 9 |

identifier |

string | Optional | The identifier of the transaction to capture. If an empty value is supplied then a trans_no value must be supplied.minLength: 4 maxLength: 50 |

transno |

integer int32 | Optional | The transaction number of the transaction to look up and capture. If an empty value is supplied then an identifier value must be supplied. |

Business Extension: Event Management

Supports the event management business extension by adding the following parameters to the request.

| Field | Type | Description |

|---|---|---|

event_management |

object | EventDataModel Additional advice data for event management integration for the capture request. |

Business Extension: Airline

Supports the airline business extension by adding the following parameters to the request.

| Field | Type | Description |

|---|---|---|

airline_data |

object | AirlineAdvice Additional advice to be applied for the capture request. |

Response

Responses for the CaptureRequest operation are

| StatusCode | Description | Content-Type | Model |

|---|---|---|---|

200 |

A result and acknowledgement of the capture request. The response will return a 000/001 response on a successful capture otherwise an error code response explaining the error. |

application/json text/xml |

Acknowledgement |

400 |

Bad Request. Should the incoming data not be validly determined. | ||

401 |

Unauthorized. No api key has been provided and is required for this operation. | ||

403 |

Forbidden. The api key was provided and understood but is either incorrect or does not have permission to access the account provided on the request. | ||

422 |

Unprocessable Entity. Should a failure occur that prevents processing of the API call. | application/json text/xml |

Error |

500 |

Server Error. The server was unable to complete the request. |

CRes

The CRes request performs authorisation processing once a challenge request has been completed

with an Authentication Server (ACS). This challenge response contains confirmation that will

allow the API systems to return an authorisation response based on the result. Our systems will

know out of band via an RReq call by the ACS to notify us if the liability shift has been issued.

Any call to the CRes operation will require a previous authorisation request and cannot be called on its own without a previous request challenge being obtained.

PaRes example request

{

"CResAuthRequest":{

"cres":"<base64>"

}

}

<CResAuthRequest>

<cres><base64></cres>

</CResAuthRequest>

Model CResAuthRequest

Request body for the CResRequest operation contains the following properties

| Field | Type | Usage | Description |

|---|---|---|---|

cres |

string base64 | Optional | The challenge response data forwarded by the ACS in 3D-Secure V2 processing. Data should be forwarded to CityPay unchanged for subsequent authorisation and processing. |

Response

Responses for the CResRequest operation are

| StatusCode | Description | Content-Type | Model |

|---|---|---|---|

200 |

A result of processing the 3DSv2 authorisation data. | application/json text/xml |

AuthResponse |

400 |

Bad Request. Should the incoming data not be validly determined. | ||

401 |

Unauthorized. No api key has been provided and is required for this operation. | ||

403 |

Forbidden. The api key was provided and understood but is either incorrect or does not have permission to access the account provided on the request. | ||

422 |

Unprocessable Entity. Should a failure occur that prevents processing of the API call. | application/json text/xml |

Error |

500 |

Server Error. The server was unable to complete the request. |

Create a Payment Intent

This endpoint initiates the creation of a payment intent, which is a precursor to processing a payment. A payment intent captures the details of a prospective payment transaction, including the payment amount, currency, and associated billing and shipping information.

Model PaymentIntent

Request body for the CreatePaymentIntent operation contains the following properties

| Field | Type | Usage | Description |

|---|---|---|---|

amount |

integer int32 | Required | The amount to authorise in the lowest unit of currency with a variable length to a maximum of 12 digits. No decimal points are to be included and no divisional characters such as 1,024. The amount should be the total amount required for the transaction. For example with GBP £1,021.95 the amount value is 102195. minLength: 1 maxLength: 9 |

identifier |

string | Required | The identifier of the transaction to process. The value should be a valid reference and may be used to perform post processing actions and to aid in reconciliation of transactions. The value should be a valid printable string with ASCII character ranges from 0x32 to 0x127. The identifier is recommended to be distinct for each transaction such as a random unique identifier this will aid in ensuring each transaction is identifiable. When transactions are processed they are also checked for duplicate requests. Changing the identifier on a subsequent request will ensure that a transaction is considered as different. minLength: 4 maxLength: 50 |

avs_postcode_policy |

string | Optional | A policy value which determines whether an AVS postcode policy is enforced or bypassed. Values are: 0 for the default policy (default value if not supplied). Your default values are determined by your account manager on setup of the account.1 for an enforced policy. Transactions that are enforced will be rejected if the AVS postcode numeric value does not match.2 to bypass. Transactions that are bypassed will be allowed through even if the postcode did not match.3 to ignore. Transactions that are ignored will bypass the result and not send postcode details for authorisation. |

bill_to |

object | Optional | ContactDetails Billing details of the card holder making the payment. These details may be used for AVS fraud analysis, 3DS and for future referencing of the transaction. For AVS to work correctly, the billing details should be the registered address of the card holder as it appears on the statement with their card issuer. The numeric details will be passed through for analysis and may result in a decline if incorrectly provided. |

csc |

string | Optional | The Card Security Code (CSC) (also known as CV2/CVV2) is normally found on the back of the card (American Express has it on the front). The value helps to identify possession of the card as it is not available within the chip or magnetic swipe. When forwarding the CSC, please ensure the value is a string as some values start with 0 and this will be stripped out by any integer parsing. The CSC number aids fraud prevention in Mail Order and Internet payments. Business rules are available on your account to identify whether to accept or decline transactions based on mismatched results of the CSC. The Payment Card Industry (PCI) requires that at no stage of a transaction should the CSC be stored. This applies to all entities handling card data. It should also not be used in any hashing process. CityPay do not store the value and have no method of retrieving the value once the transaction has been processed. For this reason, duplicate checking is unable to determine the CSC in its duplication check algorithm. minLength: 3 maxLength: 4 |

csc_policy |

string | Optional | A policy value which determines whether a CSC policy is enforced or bypassed. Values are: 0 for the default policy (default value if not supplied). Your default values are determined by your account manager on setup of the account.1 for an enforced policy. Transactions that are enforced will be rejected if the CSC value does not match.2 to bypass. Transactions that are bypassed will be allowed through even if the CSC did not match.3 to ignore. Transactions that are ignored will bypass the result and not send the CSC details for authorisation. |

currency |

string | Optional | The processing currency for the transaction. Will default to the merchant account currency. minLength: 3 maxLength: 3 |

duplicate_policy |

string | Optional | A policy value which determines whether a duplication policy is enforced or bypassed. A duplication check has a window of time set against your account within which it can action. If a previous transaction with matching values occurred within the window, any subsequent transaction will result in a T001 result. Values are 0 for the default policy (default value if not supplied). Your default values are determined by your account manager on setup of the account.1 for an enforced policy. Transactions that are enforced will be checked for duplication within the duplication window.2 to bypass. Transactions that are bypassed will not be checked for duplication within the duplication window.3 to ignore. Transactions that are ignored will have the same affect as bypass. |

match_avsa |

string | Optional | A policy value which determines whether an AVS address policy is enforced, bypassed or ignored. Values are: 0 for the default policy (default value if not supplied). Your default values are determined by your account manager on setup of the account.1 for an enforced policy. Transactions that are enforced will be rejected if the AVS address numeric value does not match.2 to bypass. Transactions that are bypassed will be allowed through even if the address did not match.3 to ignore. Transactions that are ignored will bypass the result and not send address numeric details for authorisation. |

ship_to |

object | Optional | ContactDetails Shipping details of the card holder making the payment. These details may be used for 3DS and for future referencing of the transaction. |

tag |

array | Optional | type: string |

trans_info |

string | Optional | Further information that can be added to the transaction will display in reporting. Can be used for flexible values such as operator id. maxLength: 50 |

trans_type |

string | Optional | The type of transaction being submitted. Normally this value is not required and your account manager may request that you set this field. maxLength: 1 |

Response

Responses for the CreatePaymentIntent operation are

| StatusCode | Description | Content-Type | Model |

|---|---|---|---|

200 |

Returns the id of the payment intent. | application/json text/xml |

PaymentIntentReference |

400 |

Bad Request. Should the incoming data not be validly determined. | ||

401 |

Unauthorized. No api key has been provided and is required for this operation. | ||

403 |

Forbidden. The api key was provided and understood but is either incorrect or does not have permission to access the account provided on the request. | ||

422 |

Unprocessable Entity. Should a failure occur that prevents processing of the API call. | application/json text/xml |

Error |

500 |

Server Error. The server was unable to complete the request. |

PaRes

The Payer Authentication Response (PaRes) is an operation after the result of authentication being performed. The request uses an encoded packet of authentication data to notify us of the completion of the liability shift. Once this value has been unpacked and its signature is checked, our systems will proceed to authorisation processing.

Any call to the PaRes operation will require a previous authorisation request and cannot be called on its own without a previous authentication required being obtained.

PaRes example request

{

"PaResAuthRequest":{

"md":"<string>",

"pares":"<base64>"

}

}

<PaResAuthRequest>

<md><string></md>

<pares><base64></pares>

</PaResAuthRequest>

Model PaResAuthRequest

Request body for the PaResRequest operation contains the following properties

| Field | Type | Usage | Description |

|---|---|---|---|

md |

string | Required | The Merchant Data (MD) which is a unique ID to reference the authentication session. This value will be created by CityPay when required. When responding from the ACS, this value will be returned by the ACS. |

pares |

string base64 | Required | The Payer Authentication Response packet which is returned by the ACS containing the response of the authentication session including verification values. The response is a base64 encoded packet and should be forwarded to CityPay untouched. |

Response

Responses for the PaResRequest operation are

| StatusCode | Description | Content-Type | Model |

|---|---|---|---|

200 |

A result of processing the 3DSv1 authorisation data. | application/json text/xml |

AuthResponse |

400 |

Bad Request. Should the incoming data not be validly determined. | ||

401 |

Unauthorized. No api key has been provided and is required for this operation. | ||

403 |

Forbidden. The api key was provided and understood but is either incorrect or does not have permission to access the account provided on the request. | ||

422 |

Unprocessable Entity. Should a failure occur that prevents processing of the API call. | application/json text/xml |

Error |

500 |

Server Error. The server was unable to complete the request. |

Refund

A refund request which allows for the refunding of a previous transaction up and to the amount of the original sale. A refund will be performed against the original card used to process the transaction.

Model RefundRequest

Request body for the RefundRequest operation contains the following properties

| Field | Type | Usage | Description |

|---|---|---|---|

amount |

integer int32 | Required | The amount to refund in the lowest unit of currency with a variable length to a maximum of 12 digits. The amount should be the total amount required to refund for the transaction up to the original processed amount. No decimal points are to be included and no divisional characters such as 1,024. For example with GBP £1,021.95 the amount value is 102195. minLength: 1 maxLength: 9 |

identifier |

string | Required | The identifier of the refund to process. The value should be a valid reference and may be used to perform post processing actions and to aid in reconciliation of transactions. The value should be a valid printable string with ASCII character ranges from 0x32 to 0x127. The identifier is recommended to be distinct for each transaction such as a random unique identifier this will aid in ensuring each transaction is identifiable. When transactions are processed they are also checked for duplicate requests. Changing the identifier on a subsequent request will ensure that a transaction is considered as different. minLength: 4 maxLength: 50 |

merchantid |

integer int32 | Required | Identifies the merchant account to perform the refund for. |

refund_ref |

integer int32 | Required | A reference to the original transaction number that is wanting to be refunded. The original transaction must be on the same merchant id, previously authorised. |

trans_info |

string | Optional | Further information that can be added to the transaction will display in reporting. Can be used for flexible values such as operator id. maxLength: 50 |

Response

Responses for the RefundRequest operation are

| StatusCode | Description | Content-Type | Model |

|---|---|---|---|

200 |

A result of the refund of sale processing. | application/json text/xml |

AuthResponse |

400 |

Bad Request. Should the incoming data not be validly determined. | ||

401 |

Unauthorized. No api key has been provided and is required for this operation. | ||

403 |

Forbidden. The api key was provided and understood but is either incorrect or does not have permission to access the account provided on the request. | ||

422 |

Unprocessable Entity. Should a failure occur that prevents processing of the API call. | application/json text/xml |

Error |

500 |

Server Error. The server was unable to complete the request. |

Retrieval

A retrieval request which allows an integration to obtain the result of a transaction processed in the last 90 days. The request allows for retrieval based on the identifier or transaction number.

The process may return multiple results in particular where a transaction was processed multiple times against the same identifier. This can happen if errors were first received. The API therefore returns up to the first 5 transactions in the latest date time order.

It is not intended for this operation to be a replacement for reporting and only allows for base transaction information to be returned.

Basic retrieval call for a merchant with a given identifier

{

"RetrieveRequest":{

"merchantid":123456,

"identifier":"318f2bc5-d9e0-4ddf-9df1-1ea9e4890ca9"

}

}

<RetrieveRequest>

<merchantid>123456</merchantid>

<identifier>318f2bc5-d9e0-4ddf-9df1-1ea9e4890ca9</identifier>

</RetrieveRequest>

Model RetrieveRequest

Request body for the RetrievalRequest operation contains the following properties

| Field | Type | Usage | Description |

|---|---|---|---|

merchantid |

integer int32 | Required | The merchant account to retrieve data for. |

identifier |

string | Optional | The identifier of the transaction to retrieve. Optional if a transaction number is provided. minLength: 4 maxLength: 50 |

transno |

integer int32 | Optional | The transaction number of a transaction to retrieve. Optional if an identifier is supplied. |

Response

Responses for the RetrievalRequest operation are

| StatusCode | Description | Content-Type | Model |

|---|---|---|---|

200 |

A result of the retrieval request. | application/json text/xml |

AuthReferences |

400 |

Bad Request. Should the incoming data not be validly determined. | ||

401 |

Unauthorized. No api key has been provided and is required for this operation. | ||

403 |

Forbidden. The api key was provided and understood but is either incorrect or does not have permission to access the account provided on the request. | ||

422 |

Unprocessable Entity. Should a failure occur that prevents processing of the API call. | application/json text/xml |

Error |

500 |

Server Error. The server was unable to complete the request. |

Void

The void process generally applies to transactions which have been pre-authorised only however voids can occur on the same day if performed before batching and settlement.

The void process will ensure that a transaction will now settle. It is expected that a void call will be provided on the same day before batching and settlement or within 3 days or within a maximum of 7 days.

Once the transaction has been processed as a void, an Acknowledgement will be returned,

outlining the result of the transaction.

Basic capture call for a merchant with a given identifier

{

"VoidRequest":{

"merchantid":123456,

"identifier":"318f2bc5-d9e0-4ddf-9df1-1ea9e4890ca9"

}

}

<VoidRequest>

<merchantid>123456</merchantid>

<identifier>318f2bc5-d9e0-4ddf-9df1-1ea9e4890ca9</identifier>

</VoidRequest>

Basic capture call for a merchant with a transno and final amount

{

"VoidRequest":{

"merchantid":123456,

"transno":11275

}

}

<VoidRequest>

<merchantid>123456</merchantid>

<transno>11275</transno>

</VoidRequest>

Model VoidRequest

Request body for the VoidRequest operation contains the following properties

| Field | Type | Usage | Description |

|---|---|---|---|

merchantid |

integer int32 | Required | Identifies the merchant account to perform the void for. |

identifier |

string | Optional | The identifier of the transaction to void. If an empty value is supplied then a trans_no value must be supplied.minLength: 4 maxLength: 50 |

transno |

integer int32 | Optional | The transaction number of the transaction to look up and void. If an empty value is supplied then an identifier value must be supplied. |

Response

Responses for the VoidRequest operation are

| StatusCode | Description | Content-Type | Model |

|---|---|---|---|

200 |

A result and acknowledgement of the void request, returning an 080/003 response code on successful void/cancellation of the transaction.If an error occurs an error code will be returned explaining the failure. |

application/json text/xml |

Acknowledgement |

400 |

Bad Request. Should the incoming data not be validly determined. | ||

401 |

Unauthorized. No api key has been provided and is required for this operation. | ||

403 |

Forbidden. The api key was provided and understood but is either incorrect or does not have permission to access the account provided on the request. | ||

422 |

Unprocessable Entity. Should a failure occur that prevents processing of the API call. | application/json text/xml |

Error |

500 |

Server Error. The server was unable to complete the request. |

Batch Processing Api

Batch processing uses the Batch and Instalment Service (BIS) which allows for transaction processing against cardholder accounts using a dynamic batch file. For merchants who process on their own schedules with dynamic or fixed amounts, the service allows for the presentation of cardholder account references and transaction requirements to run as a scheduled batch.

Batch Process Request

A batch process request is used to start the batch process workflow by uploading batch data and initialising a new batch for processing. Once validated the batch will be queued for processing and further updates can be received by a subsequent call to retrieve the batch status.

Model ProcessBatchRequest

Request body for the BatchProcessRequest operation contains the following properties

| Field | Type | Usage | Description |

|---|---|---|---|

batch_date |

string date | Required | The date and time that the file was created in ISO-8601 format. |

batch_id |

integer int32 | Required | The id is a referencable id for the batch that should be generated by your integration. Its recommended to use an incremental id to help determine if a batch has been skipped or missed. The id is used by reporting systems to reference the unique batch alongside your client id. maxLength: 8 minimum: 1 |

transactions |

array | Required | Transactions requested for processing. There is a logical limit of 10,000 transactions that can be processed in a single batch. The sandbox will accept up to 100 transactions. BatchTransaction |

client_account_id |

string | Optional | The batch account id to process the batch for. Defaults to your client id if not provided. minLength: 3 maxLength: 20 |

Response

Responses for the BatchProcessRequest operation are

| StatusCode | Description | Content-Type | Model |

|---|---|---|---|

200 |

Request to process a batch provided in the request. | application/json text/xml |

ProcessBatchResponse |

400 |

Bad Request. Should the incoming data not be validly determined. | ||

401 |

Unauthorized. No api key has been provided and is required for this operation. | ||

403 |

Forbidden. The api key was provided and understood but is either incorrect or does not have permission to access the account provided on the request. | ||

422 |

Unprocessable Entity. Should a failure occur that prevents processing of the API call. | application/json text/xml |

Error |

500 |

Server Error. The server was unable to complete the request. |

Batch Retrieve Request

Obtains a batch and installment (BIS) report for a given batch id.

Model BatchReportRequest

Request body for the BatchRetrieveRequest operation contains the following properties

| Field | Type | Usage | Description |

|---|---|---|---|

batch_id |

integer int32 | Required | The batch id specified in the batch processing request. maxLength: 8 minimum: 1 |

client_account_id |

string | Optional | The batch account id that the batch was processed for. Defaults to your client id if not provided. minLength: 3 maxLength: 20 |

Response

Responses for the BatchRetrieveRequest operation are

| StatusCode | Description | Content-Type | Model |

|---|---|---|---|

200 |

The report for a given batch. | application/json text/xml |

BatchReportResponseModel |

400 |

Bad Request. Should the incoming data not be validly determined. | ||

401 |

Unauthorized. No api key has been provided and is required for this operation. | ||

403 |

Forbidden. The api key was provided and understood but is either incorrect or does not have permission to access the account provided on the request. | ||

422 |

Unprocessable Entity. Should a failure occur that prevents processing of the API call. | application/json text/xml |

Error |

500 |

Server Error. The server was unable to complete the request. |

Check Batch Status

The operation is used to retrieve the status of a batch process.

Model CheckBatchStatus

Request body for the CheckBatchStatusRequest operation contains the following properties

| Field | Type | Usage | Description |

|---|---|---|---|

batch_id |

array | Required | type: integer |

client_account_id |

string | Optional | The batch account id to obtain the batch for. Defaults to your client id if not provided. minLength: 3 maxLength: 20 |

Response

Responses for the CheckBatchStatusRequest operation are

| StatusCode | Description | Content-Type | Model |

|---|---|---|---|

200 |

The status of batches provided in the request. | application/json text/xml |

CheckBatchStatusResponse |

400 |

Bad Request. Should the incoming data not be validly determined. | ||

401 |

Unauthorized. No api key has been provided and is required for this operation. | ||

403 |

Forbidden. The api key was provided and understood but is either incorrect or does not have permission to access the account provided on the request. | ||

422 |

Unprocessable Entity. Should a failure occur that prevents processing of the API call. | application/json text/xml |

Error |

500 |

Server Error. The server was unable to complete the request. |

Card Holder Account Api

A cardholder account models a cardholder and can register 1 or more cards for tokenised charging.

The account offers a credential on file option to the CityPay gateway allowing for both cardholder initiated and merchant initiated transaction processing.

This can include unscheduled or scheduled transactions that can be requested through this API and include batch processing options.

Account Exists

Checks that an account exists and is active by providing the account id as a url parameter.

Path Parameters

| Name | Required | Description |

|---|---|---|

accountid |

true | The account id that refers to the customer's account no. This value will have been provided when setting up the card holder account. |

Response

Responses for the AccountExistsRequest operation are

| StatusCode | Description | Content-Type | Model |

|---|---|---|---|

200 |

A response model determining whether the account exists, if exists is true, a last modified date of the account is also provided. | application/json text/xml |

Exists |

400 |

Bad Request. Should the incoming data not be validly determined. | ||

401 |

Unauthorized. No api key has been provided and is required for this operation. | ||

403 |

Forbidden. The api key was provided and understood but is either incorrect or does not have permission to access the account provided on the request. | ||

422 |

Unprocessable Entity. Should a failure occur that prevents processing of the API call. | application/json text/xml |

Error |

500 |

Server Error. The server was unable to complete the request. |

Account Create

Creates a new card holder account and initialises the account ready for adding cards.

Model AccountCreate

Request body for the AccountCreate operation contains the following properties

| Field | Type | Usage | Description |

|---|---|---|---|

account_id |

string | Required | A card holder account id used for uniquely identifying the account. This value will be used for future referencing of the account oand to link your system to this API. This value is immutable and never changes. minLength: 5 maxLength: 50 |

contact |

object | Optional | ContactDetails Contact details for a card holder account. |

Response

Responses for the AccountCreate operation are

| StatusCode | Description | Content-Type | Model |

|---|---|---|---|

200 |

Provides an initialised account. | application/json text/xml |

CardHolderAccount |

400 |

Bad Request. Should the incoming data not be validly determined. | ||

401 |

Unauthorized. No api key has been provided and is required for this operation. | ||

403 |

Forbidden. The api key was provided and understood but is either incorrect or does not have permission to access the account provided on the request. | ||

422 |

Unprocessable Entity. Should a failure occur that prevents processing of the API call. | application/json text/xml |

Error |

500 |

Server Error. The server was unable to complete the request. |

Account Retrieval

Allows for the retrieval of a card holder account for the given id. Should duplicate accounts exist

for the same id, the first account created with that id will be returned.

The account can be used for tokenisation processing by listing all cards assigned to the account.

The returned cards will include all active, inactive and expired cards. This can be used to

enable a card holder to view their wallet and make constructive choices on which card to use.

Path Parameters

| Name | Required | Description |

|---|---|---|

accountid |

true | The account id that refers to the customer's account no. This value will have been provided when setting up the card holder account. |

Response

Responses for the AccountRetrieveRequest operation are

| StatusCode | Description | Content-Type | Model |

|---|---|---|---|

200 |

A card holder account that matches the account id provided in the request. | application/json text/xml |

CardHolderAccount |

400 |

Bad Request. Should the incoming data not be validly determined. | ||

401 |

Unauthorized. No api key has been provided and is required for this operation. | ||

403 |

Forbidden. The api key was provided and understood but is either incorrect or does not have permission to access the account provided on the request. | ||

422 |

Unprocessable Entity. Should a failure occur that prevents processing of the API call. | application/json text/xml |

Error |

500 |

Server Error. The server was unable to complete the request. |

Account Deletion

Allows for the deletion of an account. The account will marked for deletion and subsequent purging. No further transactions will be alowed to be processed or actioned against this account.

Path Parameters

| Name | Required | Description |

|---|---|---|

accountid |

true | The account id that refers to the customer's account no. This value will have been provided when setting up the card holder account. |

Response

Responses for the AccountDeleteRequest operation are

| StatusCode | Description | Content-Type | Model |

|---|---|---|---|

200 |

An acknowledgment code of 001 that the card holder account has been marked for deletion. |

application/json text/xml |

Acknowledgement |

400 |

Bad Request. Should the incoming data not be validly determined. | ||

401 |

Unauthorized. No api key has been provided and is required for this operation. | ||

403 |

Forbidden. The api key was provided and understood but is either incorrect or does not have permission to access the account provided on the request. | ||

422 |

Unprocessable Entity. Should a failure occur that prevents processing of the API call. | application/json text/xml |

Error |

500 |

Server Error. The server was unable to complete the request. |

Card Deletion

Deletes a card from the account. The card will be marked for deletion before a subsequent purge will clear the card permanently.

Path Parameters

| Name | Required | Description |

|---|---|---|

accountid |

true | The account id that refers to the customer's account no. This value will have been provided when setting up the card holder account. |

cardId |

true | The id of the card that is presented by a call to retrieve a card holder account. |

Response

Responses for the AccountCardDeleteRequest operation are

| StatusCode | Description | Content-Type | Model |

|---|---|---|---|

200 |

Acknowledges the card has been requested for deletion. A response code of 001 is returned if the account is available for deletion otherwise an error code is returned. |

application/json text/xml |

Acknowledgement |

400 |

Bad Request. Should the incoming data not be validly determined. | ||

401 |

Unauthorized. No api key has been provided and is required for this operation. | ||

403 |

Forbidden. The api key was provided and understood but is either incorrect or does not have permission to access the account provided on the request. | ||

422 |

Unprocessable Entity. Should a failure occur that prevents processing of the API call. | application/json text/xml |

Error |

500 |

Server Error. The server was unable to complete the request. |

Card Status

Updates the status of a card for processing. The following values are available

| Status | Description |

|---|---|

| Active | The card is active for processing and can be used for charging against with a valid token |

| Inactive | The card is inactive for processing and cannot be used for processing, it will require reactivation before being used to charge |

| Expired | The card has expired either due to the expiry date no longer being valid or due to a replacement card being issued |

Path Parameters

| Name | Required | Description |

|---|---|---|

accountid |

true | The account id that refers to the customer's account no. This value will have been provided when setting up the card holder account. |

cardId |

true | The id of the card that is presented by a call to retrieve a card holder account. |

Model CardStatus

Request body for the AccountCardStatusRequest operation contains the following properties

| Field | Type | Usage | Description |

|---|---|---|---|

card_status |

string | Optional | The status of the card to set, valid values are ACTIVE or INACTIVE. |

default |

boolean | Optional | Defines if the card is set as the default. |

Response

Responses for the AccountCardStatusRequest operation are

| StatusCode | Description | Content-Type | Model |

|---|---|---|---|

200 |

Acknowledges the card status has changed, returning a response code of 001 for a valid change or 000 for a non valid change. |

application/json text/xml |

Acknowledgement |

400 |

Bad Request. Should the incoming data not be validly determined. | ||

401 |

Unauthorized. No api key has been provided and is required for this operation. | ||

403 |

Forbidden. The api key was provided and understood but is either incorrect or does not have permission to access the account provided on the request. | ||

422 |

Unprocessable Entity. Should a failure occur that prevents processing of the API call. | application/json text/xml |

Error |

500 |

Server Error. The server was unable to complete the request. |

Contact Details Update

Allows for the ability to change the contact details for an account.

Path Parameters

| Name | Required | Description |

|---|---|---|

accountid |

true | The account id that refers to the customer's account no. This value will have been provided when setting up the card holder account. |

Model ContactDetails

Request body for the AccountChangeContactRequest operation contains the following properties

| Field | Type | Usage | Description |

|---|---|---|---|

address1 |

string | Optional | The first line of the address for the card holder. maxLength: 50 |

address2 |

string | Optional | The second line of the address for the card holder. maxLength: 50 |

address3 |

string | Optional | The third line of the address for the card holder. maxLength: 50 |

area |

string | Optional | The area such as city, department, parish for the card holder. maxLength: 50 |

company |

string | Optional | The company name for the card holder if the contact is a corporate contact. maxLength: 50 |

country |

string | Optional | The country code in ISO 3166 format. The country value may be used for fraud analysis and for acceptance of the transaction. minLength: 2 maxLength: 2 |

email |

string | Optional | An email address for the card holder which may be used for correspondence. maxLength: 254 |

firstname |

string | Optional | The first name of the card holder. |

lastname |

string | Optional | The last name or surname of the card holder. |

mobile_no |

string | Optional | A mobile number for the card holder the mobile number is often required by delivery companies to ensure they are able to be in contact when required. maxLength: 20 |

postcode |

string | Optional | The postcode or zip code of the address which may be used for fraud analysis. maxLength: 16 |

telephone_no |

string | Optional | A telephone number for the card holder. maxLength: 20 |

title |

string | Optional | A title for the card holder such as Mr, Mrs, Ms, M. Mme. etc. |

Response

Responses for the AccountChangeContactRequest operation are

| StatusCode | Description | Content-Type | Model |

|---|---|---|---|

200 |

A revised account with the new details set. | application/json text/xml |

CardHolderAccount |

400 |

Bad Request. Should the incoming data not be validly determined. | ||

401 |

Unauthorized. No api key has been provided and is required for this operation. | ||

403 |

Forbidden. The api key was provided and understood but is either incorrect or does not have permission to access the account provided on the request. | ||

422 |

Unprocessable Entity. Should a failure occur that prevents processing of the API call. | application/json text/xml |

Error |

500 |

Server Error. The server was unable to complete the request. |

Card Registration

Allows for a card to be registered for the account. The card will be added for future processing and will be available as a tokenised value for future processing.

The card will be validated for

- Being a valid card number (luhn check)

- Having a valid expiry date

- Being a valid bin value.

Path Parameters

| Name | Required | Description |

|---|---|---|

accountid |

true | The account id that refers to the customer's account no. This value will have been provided when setting up the card holder account. |

Model RegisterCard

Request body for the AccountCardRegisterRequest operation contains the following properties

| Field | Type | Usage | Description |

|---|---|---|---|

cardnumber |

string | Required | The primary number of the card. minLength: 12 maxLength: 22 |

expmonth |

integer int32 | Required | The expiry month of the card. minimum: 1 maximum: 12 |

expyear |

integer int32 | Required | The expiry year of the card. minimum: 2000 maximum: 2100 |

default |

boolean | Optional | Determines whether the card should be the new default card. |

name_on_card |

string | Optional | The card holder name as it appears on the card. The value is required if the account is to be used for 3dsv2 processing, otherwise it is optional. minLength: 2 maxLength: 45 |

Response

Responses for the AccountCardRegisterRequest operation are

| StatusCode | Description | Content-Type | Model |

|---|---|---|---|

200 |

A successfully registered card provides a reload of the account including the new card. | application/json text/xml |

CardHolderAccount |

400 |

Bad Request. Should the incoming data not be validly determined. | ||

401 |

Unauthorized. No api key has been provided and is required for this operation. | ||

403 |

Forbidden. The api key was provided and understood but is either incorrect or does not have permission to access the account provided on the request. | ||

422 |

Unprocessable Entity. Should a failure occur that prevents processing of the API call. | application/json text/xml |

Error |

500 |

Server Error. The server was unable to complete the request. |

Account Status

Updates the status of an account. An account can have the following statuses applied

| Status | Description |

|---|---|

| Active | The account is active for processing |

| Disabled | The account has been disabled and cannot be used for processing. The account will require reactivation to continue procesing |

Path Parameters

| Name | Required | Description |

|---|---|---|

accountid |

true | The account id that refers to the customer's account no. This value will have been provided when setting up the card holder account. |

Model AccountStatus

Request body for the AccountStatusRequest operation contains the following properties

| Field | Type | Usage | Description |

|---|---|---|---|

status |

string | Optional | The status of the account to set, valid values are ACTIVE or DISABLED. |

Response

Responses for the AccountStatusRequest operation are

| StatusCode | Description | Content-Type | Model |

|---|---|---|---|

200 |

An acknowledgment that the card holder account status has been updated.A response code of 001 is returned if the request was accepted or no change required.A response code of 000 is returned if the request contains invalid data. |

application/json text/xml |

Acknowledgement |

400 |

Bad Request. Should the incoming data not be validly determined. | ||

401 |

Unauthorized. No api key has been provided and is required for this operation. | ||

403 |

Forbidden. The api key was provided and understood but is either incorrect or does not have permission to access the account provided on the request. | ||

422 |

Unprocessable Entity. Should a failure occur that prevents processing of the API call. | application/json text/xml |

Error |

500 |

Server Error. The server was unable to complete the request. |

Charge

A charge process obtains an authorisation using a tokenised value which represents a stored card

on a card holder account.

A card must previously be registered by calling /account-register-card with the card details

or retrieved using /account-retrieve

Tokens are generated whenever a previously registered list of cards are retrieved. Each token has, by design a relatively short time to live of 30 minutes. This is both to safe guard the merchant and card holder from replay attacks. Tokens are also restricted to your account, preventing malicious actors from stealing details for use elsewhere.

If a token is reused after it has expired it will be rejected and a new token will be required.

Tokenisation can be used for

- repeat authorisations on a previously stored card

- easy authorisations just requiring CSC values to be entered

- can be used for credential on file style payments

- can require full 3-D Secure authentication to retain the liability shift

- wallet style usage

Should an account be used with 3DSv2, the card holder name should also be stored alongside the card as this is a required field with both Visa and MasterCard for risk analysis..

Model ChargeRequest